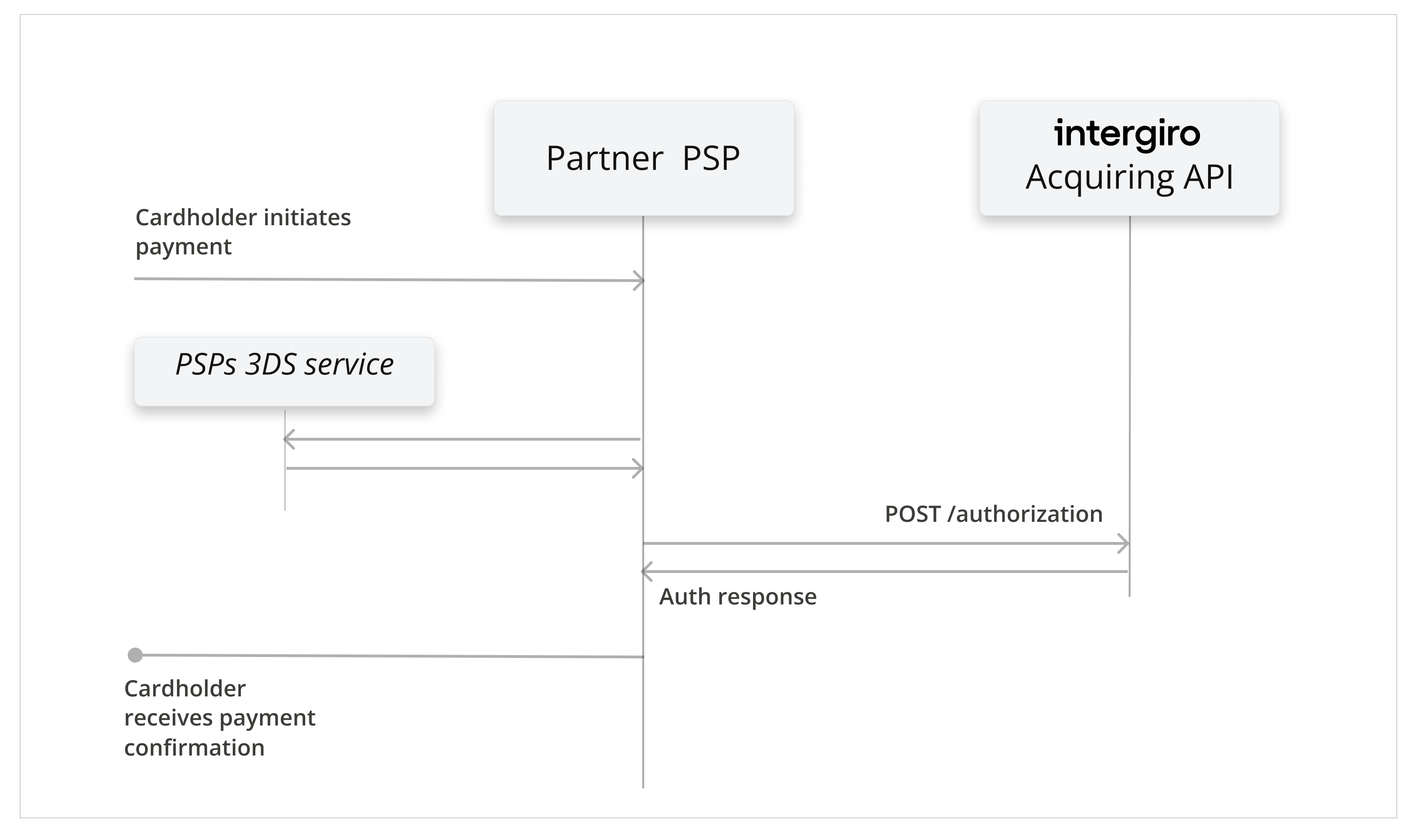

# S2S with customers 3DS (For PSPs)

# How it works

This integration is suitable if you are entirely managing the 3DS service on your end.

# Integration steps

# Perform 3DS authentication

If your use-case requires it, make sure to perform any necessary 3DS steps on your end before reaching our API. E.g. when the customer is present and making a payment, 3DS is almost always required.

# Create an authorization

Prepare an authorization creatable object.

{

"number": "<merchant_tx_id>",

"amount": 7.52,

"currency": "EUR",

"card": {

"pan": "4111111111111111",

"expires": [2, 22],

"csc": "987",

"verification": {

// <3DS Data>

}

},

"browser": {

"ip": "213.138.91.2", // REQUIRED with Server-Server flow

"ipCountry": "SE" // REQUIRED with Server-Server flow

},

"contact": {

"email": "cardholder.email@example.com"

}

}

# Add 3DS data to the authorization

If customer has gone through the 3DS flow, the authorization is required to contain a Verification object with the resulting 3DS data.

All data in the example is required.

"verification": {

"data": {

"authenticationValue": "<string>",

"dsTransID": "<string>",

"messageVersion": "2.1.0" | "2.2.0",

"messageType": "RReq" | "ARes",

"eci": "<string>",

"threeDSServerTransID": "<string>",

"transStatus": "Y" | "N" | "U" | "A" | "C" | "R"

}

}

# Send the request

POST <base_url>/v1/authorization

Content-Type: application/json

AuthorizationObject

# Receive a response

The authorization response will be either:

- A "Verification required" error response with status 400, indicating that 3DS data was not provided

- A successful authorization response with status 201, indicating authorization was approved by the issuer

- A failed authorization with reasons of failure.

# Example

A full example can be accessed from the github repository or downloaded as a html file. To test the code, a public api key without 3D configurations is required to be added to the const key in the code.